Do you have have unused 529 funds and not sure what happens next? This blog post will help you better understand what will happen unused 529 funds.

Table of Contents

What Happens to Unused 529 Funds?

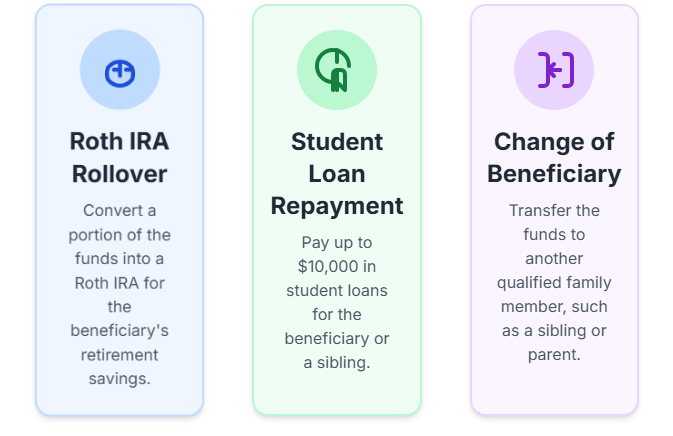

Short answer: You don’t lose unused 529 funds. You can change the beneficiary, roll funds into another 529, use them for student loans, or — in some cases — roll over into a Roth IRA. Non-qualified withdrawals are allowed but may trigger taxes and penalties.

Qualified vs. Non-Qualified Withdrawals

529 plans are built to cover qualified education expenses such as tuition, fees, books, supplies, certain room & board, approved apprenticeship costs, and some K–12 expenses. Funds used for those purposes are withdrawn tax-free.

If you withdraw money for non-qualified purposes, the earnings portion of the withdrawal is subject to ordinary income tax and usually a 10% federal penalty. Your original contributions are returned tax-free. Note that some states may recapture tax deductions or credits you previously received.

What If My Child Gets a Scholarship?

If the beneficiary receives a tax-free scholarship, you may withdraw up to the scholarship amount penalty-free (the 10% federal penalty is waived). You will still owe income tax on the earnings portion of that withdrawal, but avoiding the penalty can make withdrawing sensible in many cases.

Can I Change the Beneficiary of a 529 Plan?

Yes. You can change the beneficiary to another qualifying family member without taxes or penalties. Typical qualifying relatives include siblings, parents, children, cousins, nieces/nephews, and often in-laws. Changing the beneficiary is a common way to repurpose unused funds — for example, to a younger sibling or to a parent returning to school.

Can I Roll Over or Transfer 529 Funds?

Rollover to Another 529

You can move unused funds to another 529 plan for the same beneficiary or for a different qualifying family member. This is a straightforward, tax-free way to preserve the tax advantages while shifting the intended student.

Rollover to a Roth IRA (SECURE 2.0 Update)

Under recent federal changes, there is now a pathway to roll some 529 dollars into a Roth IRA for the beneficiary — subject to restrictions. Important points to know:

- The 529 account typically must have been open for at least 15 years.

- There is a lifetime rollover cap (commonly referenced as $35,000) and rollovers are subject to annual Roth contribution limits.

- Other rules and eligibility requirements apply; consult a tax or financial advisor for the specifics in your situation.

Can 529 Funds Be Used to Pay Student Loans?

Yes. You may use up to $10,000 (lifetime limit) from a 529 plan to pay the beneficiary’s qualified student loans. In some cases, another $10,000 may be applied toward each sibling’s student loans. This option helps reduce debt while making use of leftover college savings.

Do 529 Funds Expire?

No. There is no federal expiration date on 529 funds — the account can remain open indefinitely and continue to grow tax-free. That flexibility allows families to save for future graduate education, trade school, certification programs, or even future generations.

What If I Just Withdraw the Money?

If you take a non-qualified withdrawal, you will typically owe:

- Federal (and possibly state) income tax on the earnings portion of the withdrawal, and

- A 10% federal penalty on the earnings (unless an exception applies).

Example: You contributed $20,000 into a 529 and the account value grew to $30,000. If you withdraw the full $30,000 for a non-qualified purpose, only the $10,000 in earnings is taxable and subject to the 10% penalty; the original $20,000 in contributions is returned tax-free.

Special Scenarios to Know About

- Tuition refunds: If a school refunds tuition, you can usually redeposit that refund into the 529 to avoid taxes/penalties.

- Beneficiary death or disability: The 10% penalty is often waived in these cases, though taxes on earnings still apply.

- Owner as beneficiary: The account owner can make themselves the beneficiary to pursue additional education later.

State vs. Federal Rules on 529 Withdrawals

Federal tax rules govern whether withdrawals are tax-free for qualified expenses. However, state rules vary — many states offer tax deductions or credits for contributions, and some states will recapture those benefits if funds are used for non-qualified purposes. Always check your state’s 529 plan details before making major moves.

What to Do If You Have Unused 529 Funds

- Assess likely future education needs (graduate school, certifications, trade programs).

- Consider changing the beneficiary to another qualifying family member.

- Explore paying down student loans with up to $10,000 of 529 funds.

- Look into the Roth IRA rollover option if your account and beneficiary meet the requirements.

- If none of the above works, calculate the net cost of a non-qualified withdrawal (taxes + penalties) before deciding.

Key Takeaways

- You don’t lose unused 529 plan funds — multiple repurposing options exist.

- Scholarships allow penalty-free withdrawals up to the award amount (earnings still taxable).

- You can change beneficiaries or roll funds into another 529 without tax consequences.

- The Roth IRA rollover creates new flexibility but has limits and rules.

- Non-qualified withdrawals are always possible but usually cost taxes and penalties on earnings.

Disclaimer: This article is for informational purposes only and does not constitute tax or financial advice. Rules for 529 plans and Roth rollovers can change and may vary by state. Consult a qualified financial advisor or tax professional about your specific situation.